Table of contents

- Breaking Down Barriers to Financial Inclusion

- Cross-Border Transactions Made Easy

- Enabling Microfinance and Peer-to-Peer Lending

- Enhancing Transparency and Trust

- Lowering the Cost of Financial Services

- Facilitating Trade and Supply Chain Financing

- Building a Resilient Financial Ecosystem

- Empowering Africa’s Future

- Partnership with DLT Africa

- Conclusion

In the era of globalization, financial inclusion remains a pressing challenge. Millions, particularly in regions like Africa, lack access to basic financial services, leaving them marginalized from economic opportunities. CrossFi, a revolutionary concept bridging traditional finance (TradFi) and decentralized finance (DeFi), offers tangible solutions to these long-standing issues. By leveraging blockchain technology and a hybrid architecture rooted in Cosmos and Ethereum, CrossFi provides a platform that promises transparency, accessibility, and efficiency in addressing global financial inequities.

Breaking Down Barriers to Financial Inclusion

One of CrossFi’s most significant contributions lies in its ability to serve the underbanked and unbanked populations. In Africa, where over 50% of adults lack access to formal financial institutions, CrossFi opens the door to services like savings, loans, and payments. By integrating DeFi protocols with local TradFi systems, individuals can access financial products through smartphones, bypassing the need for conventional banking infrastructure. This ease of access empowers rural communities to participate in the economy, Allowing for financial independence.

Cross-Border Transactions Made Easy

Cross-border payments in Africa are notoriously expensive and slow, with fees averaging 7% to 10% per transaction and processing times stretching over several days. CrossFi addresses this inefficiency by offering near-instantaneous, low-cost cross-border transactions. Through blockchain’s decentralized nature, intermediaries are eliminated, ensuring that more money stays in the hands of users. Whether it’s remittances from the diaspora or trade settlements between countries, CrossFi makes international financial interactions seamless and cost-effective.

Enabling Microfinance and Peer-to-Peer Lending

Africa’s small businesses and entrepreneurs often struggle to secure credit due to the lack of formal credit histories. CrossFi’s DeFi components can introduce decentralized lending platforms that assess creditworthiness through alternative data, such as transaction patterns and community endorsements. Smart contracts ensure transparent and secure loan agreements, reducing the risk for lenders while enabling borrowers to access capital. This will encourage a culture of entrepreneurship and drives economic growth at the grassroots level.

Enhancing Transparency and Trust

Corruption and lack of trust in financial institutions are significant barriers in Africa. CrossFi’s blockchain foundation ensures that every transaction is recorded on an immutable ledger, promoting accountability and transparency. This is particularly impactful for government programs, aid distribution, and NGOs operating in the region. By using CrossFi systems, funds can be tracked in real-time, reducing leakage and ensuring resources reach their intended beneficiaries.

Lowering the Cost of Financial Services

Traditional banking systems often come with high operational costs, which are passed on to consumers in the form of exorbitant fees. CrossFi’s decentralized infrastructure drastically reduces these costs, allowing financial services to be more affordable. From insurance premiums to transaction fees, users benefit from significant savings, making these services accessible to a broader population.

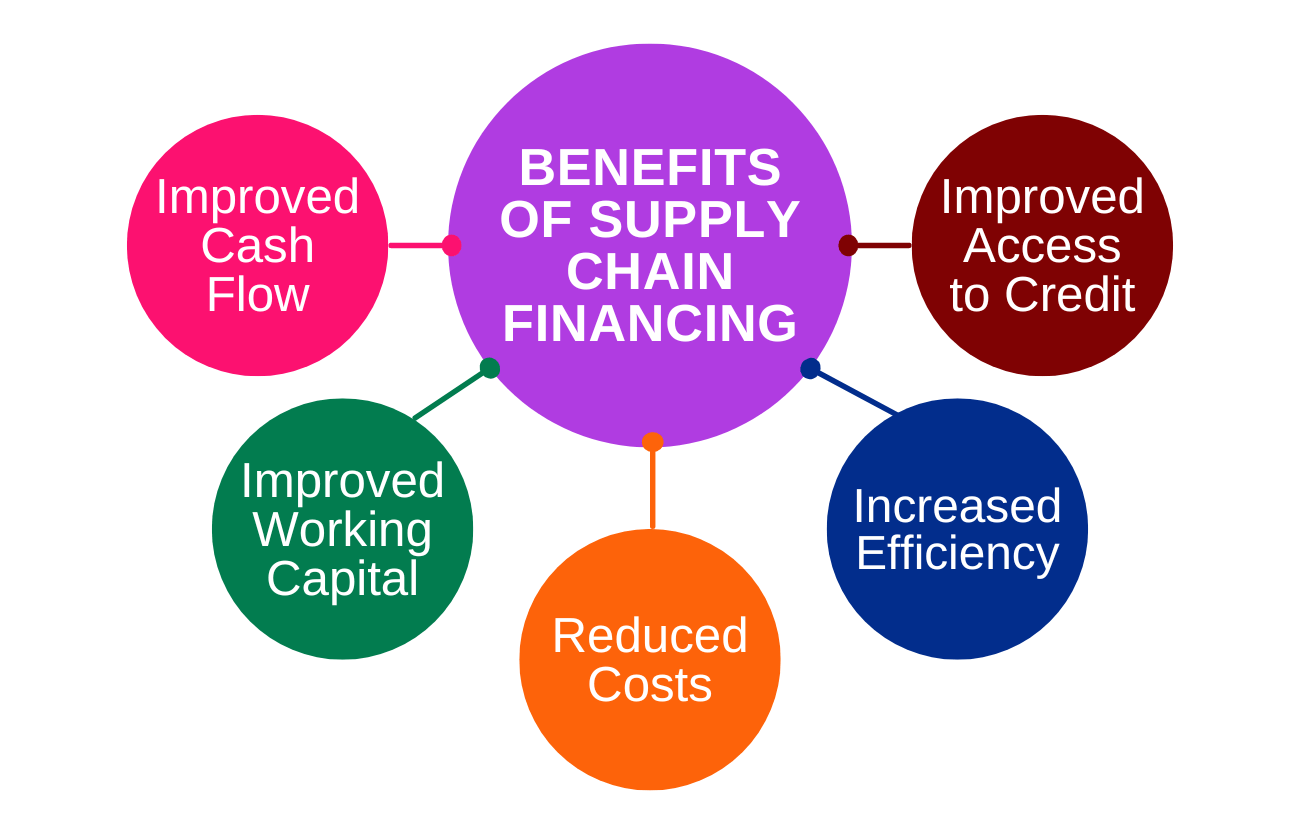

Facilitating Trade and Supply Chain Financing

Africa’s trade ecosystem faces challenges such as limited access to trade financing and lack of transparency in supply chains. CrossFi’s smart contracts and tokenization capabilities streamline trade finance processes, ensuring that payments are automated and contingent on agreed conditions being met. This reduces delays and builds trust among trading partners. Moreover, blockchain’s traceability features enhance supply chain management, making it easier to verify the origin and authenticity of goods.

Building a Resilient Financial Ecosystem

CrossFi’s dual focus on TradFi and DeFi allows it to create a resilient financial ecosystem that adapts to diverse needs. While DeFi offers innovation and decentralization, TradFi provides stability and regulatory compliance. This hybrid model ensures that CrossFi’s solutions can integrate seamlessly with existing financial systems while introducing cutting-edge functionalities.

Empowering Africa’s Future

CrossFi’s mission aligns closely with Africa’s aspirations for economic transformation. By addressing key financial challenges such as inclusion, affordability, and efficiency, CrossFi empowers individuals and businesses to unlock their full potential. For Africa’s youth, who are increasingly embracing digital solutions, CrossFi represents an opportunity to leapfrog traditional barriers and build a future defined by innovation and prosperity.

Partnership with DLT Africa

In a significant stride towards building a robust financial ecosystem in Africa, CrossFi has partnered with DLT Africa. This collaboration focuses on developing an ecosystem that empowers local developers to recognize Africa’s unique financial challenges and build tailored solutions. By outsourcing and nurturing talent within the region, CrossFi and DLT Africa aim to bridge the gap between problem identification and solution implementation. This partnership not only fosters local innovation but also ensures that solutions are deeply rooted in the realities of African economies.

Conclusion

CrossFi isn’t just a technological innovation; it’s a movement towards equitable and inclusive finance. For regions like Africa, where traditional financial systems have often fallen short, CrossFi provides a lifeline to economic participation and growth. By bridging the gap between TradFi and DeFi, and partnering with initiatives like DLT Africa, CrossFi is not only solving global financial problems but also paving the way for a brighter, more inclusive future for all.